House Rent Allowance Under Section 10 13A Form Download . house rent allowance (hra) calculator calculates house rent allowance which is exempt from tax u/s. as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based upon the following 1). A deduction is permissible under section 10 (13a) of the. salaried individuals living in a rented house can claim hra exemption under section 10 (13a) of the income tax. section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. house rent allowance (hra) is received by the salaried class. hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). On the other hand, self

from www.vrogue.co

house rent allowance (hra) calculator calculates house rent allowance which is exempt from tax u/s. section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. salaried individuals living in a rented house can claim hra exemption under section 10 (13a) of the income tax. house rent allowance (hra) is received by the salaried class. as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based upon the following 1). A deduction is permissible under section 10 (13a) of the. hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). On the other hand, self house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent.

House Rent Receipt Nsasearch vrogue.co

House Rent Allowance Under Section 10 13A Form Download On the other hand, self house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. On the other hand, self house rent allowance (hra) calculator calculates house rent allowance which is exempt from tax u/s. section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. salaried individuals living in a rented house can claim hra exemption under section 10 (13a) of the income tax. as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based upon the following 1). hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). A deduction is permissible under section 10 (13a) of the. house rent allowance (hra) is received by the salaried class.

From www.studocu.com

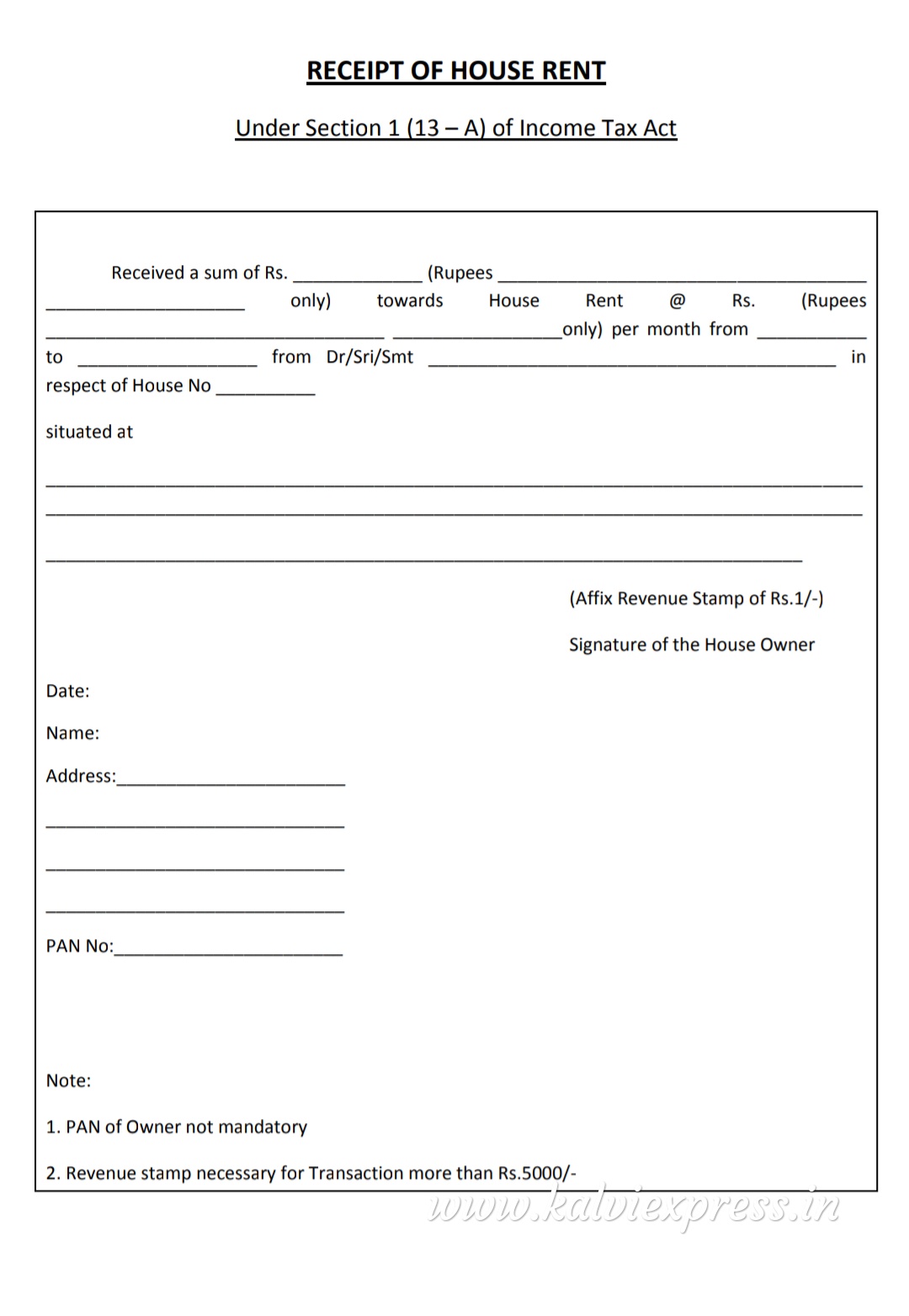

Rent receipt rent RECEIPT OF HOUSE RENT (Under Section 10(13A) of House Rent Allowance Under Section 10 13A Form Download hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. as per. House Rent Allowance Under Section 10 13A Form Download.

From www.youtube.com

House Rent Allowance (HRA) Exemption U/s 10(13A) + Problem from CA House Rent Allowance Under Section 10 13A Form Download salaried individuals living in a rented house can claim hra exemption under section 10 (13a) of the income tax. house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. house rent allowance (hra) calculator calculates house rent allowance which is exempt from tax u/s. house rent allowance. House Rent Allowance Under Section 10 13A Form Download.

From www.youtube.com

HRA Calculation Tax Section 10(13A) of IT Act HRA House House Rent Allowance Under Section 10 13A Form Download house rent allowance (hra) calculator calculates house rent allowance which is exempt from tax u/s. as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based upon the following 1). house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. house. House Rent Allowance Under Section 10 13A Form Download.

From gstguntur.com

House Rent Allowance HRA Section 10 (13A) Best Guide on HRA Exemption House Rent Allowance Under Section 10 13A Form Download section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). A deduction is. House Rent Allowance Under Section 10 13A Form Download.

From dxosrcjvj.blob.core.windows.net

House Rent Form In Hindi at Simon Kissinger blog House Rent Allowance Under Section 10 13A Form Download On the other hand, self house rent allowance (hra) is received by the salaried class. section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. A deduction is permissible under section 10 (13a) of the. house rent allowance (hra) is an allowance paid by an employer. House Rent Allowance Under Section 10 13A Form Download.

From www.youtube.com

How to calculate the exemption of House rent allowance under section 10 House Rent Allowance Under Section 10 13A Form Download A deduction is permissible under section 10 (13a) of the. house rent allowance (hra) is received by the salaried class. On the other hand, self section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. as per section 10 (13a) and rule 2a exemption in respect. House Rent Allowance Under Section 10 13A Form Download.

From www.taxguidenilesh.com

हाउस रेंट अलाउंस House Rent Allowance under section 10(13A) limit House Rent Allowance Under Section 10 13A Form Download house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based. House Rent Allowance Under Section 10 13A Form Download.

From housing.com

House Rent Allowance under Section 10(13A) House Rent Allowance Under Section 10 13A Form Download A deduction is permissible under section 10 (13a) of the. salaried individuals living in a rented house can claim hra exemption under section 10 (13a) of the income tax. On the other hand, self house rent allowance (hra) is received by the salaried class. house rent allowance (hra) calculator calculates house rent allowance which is exempt from. House Rent Allowance Under Section 10 13A Form Download.

From www.nobroker.in

House Rent Allowance under Section 10 13A Calculation and Exemption House Rent Allowance Under Section 10 13A Form Download house rent allowance (hra) is received by the salaried class. hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). section 10 (13a) allows you to claim hra (house rent allowance) if you. House Rent Allowance Under Section 10 13A Form Download.

From www.youtube.com

hra exemption for salaried employees house rent allowance under House Rent Allowance Under Section 10 13A Form Download house rent allowance (hra) calculator calculates house rent allowance which is exempt from tax u/s. as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based upon the following 1). house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. salaried. House Rent Allowance Under Section 10 13A Form Download.

From www.nobroker.in

House Rent Allowance under Section 10 13A Calculation and Exemption House Rent Allowance Under Section 10 13A Form Download hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. salaried individuals. House Rent Allowance Under Section 10 13A Form Download.

From www.youtube.com

[Section10(13A)] Exemption on House Rent Allowance Tax Act House Rent Allowance Under Section 10 13A Form Download house rent allowance (hra) calculator calculates house rent allowance which is exempt from tax u/s. house rent allowance (hra) is received by the salaried class. house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. On the other hand, self salaried individuals living in a rented house. House Rent Allowance Under Section 10 13A Form Download.

From www.scribd.com

(Under Section 10 (13A) of Tax Act) Receipt of House Rent PDF House Rent Allowance Under Section 10 13A Form Download as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based upon the following 1). house rent allowance (hra) is received by the salaried class. hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule. House Rent Allowance Under Section 10 13A Form Download.

From rent-receipt-form.pdffiller.com

Rent Receipt Pdf Fill Online, Printable, Fillable, Blank pdfFiller House Rent Allowance Under Section 10 13A Form Download section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. house rent allowance (hra) calculator calculates house rent allowance which is exempt from tax u/s. as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based upon the following 1).. House Rent Allowance Under Section 10 13A Form Download.

From www.scribd.com

Receipt of House Rent (Under Section 10 (13A) of Tax Act) PDF House Rent Allowance Under Section 10 13A Form Download On the other hand, self house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. A deduction is permissible under section 10 (13a) of the. as per section 10 (13a) and rule 2a exemption in respect of house rent allowance is based upon the following 1). house rent. House Rent Allowance Under Section 10 13A Form Download.

From www.scribd.com

Receipt of House Rent Payment (See Section 10 (13A) and Rule 2A) PDF House Rent Allowance Under Section 10 13A Form Download On the other hand, self hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). house rent allowance (hra) is received by the salaried class. house rent allowance (hra) calculator calculates house rent. House Rent Allowance Under Section 10 13A Form Download.

From www.youtube.com

Calculation of House Rent Allowance (HRA) Tax Exemption under House Rent Allowance Under Section 10 13A Form Download house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. section 10 (13a) allows you to claim hra (house rent allowance) if you stay on rent and receive hra amount in. house rent allowance (hra) is received by the salaried class. hra (house rent allowance) is accounted. House Rent Allowance Under Section 10 13A Form Download.

From www.nobroker.in

House Rent Allowance under Section 10 13A Calculation and Exemption House Rent Allowance Under Section 10 13A Form Download hra (house rent allowance) is accounted for in the case of salaried people under section 10 (13a) of income tax act, 1961, in accordance with rule 2a of income tax rules (hra exemption rules). house rent allowance (hra) is an allowance paid by an employer to its employees for covering their house rent. salaried individuals living in. House Rent Allowance Under Section 10 13A Form Download.